north dakota sales tax nexus

Of note the North Dakota Governor eliminated the 200 transaction sales tax economic nexus threshold effective March 14 2019. DO I NEED A SALES TAX PERMIT IN NORTH DAKOTA.

Tax Experts Explain Supreme Court Decision On Nexus

Responds to notices issued by states and local tax jurisdictions.

. 53 rows North Carolina Economic Nexus North Dakota. This now leaves only the 100000 threshold effective for tax years beginning after December 31 2018. In the previous or current calendar year.

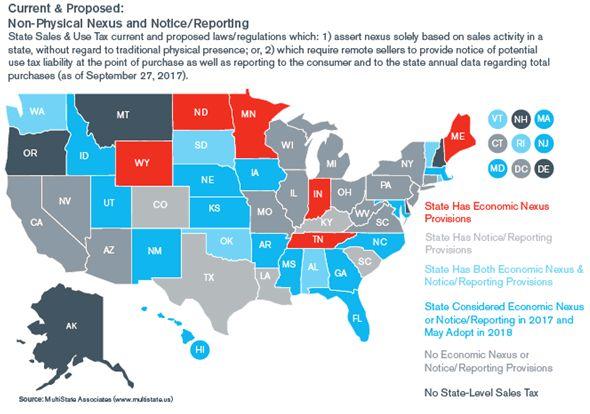

Wayfair in 2018 Quill Corporation v. After June 30 2019 those remote sellers may cancel their North Dakota sales and use tax permit and discontinue collecting North Dakota sales tax. NORTH DAKOTA SALES TAX NEXUS.

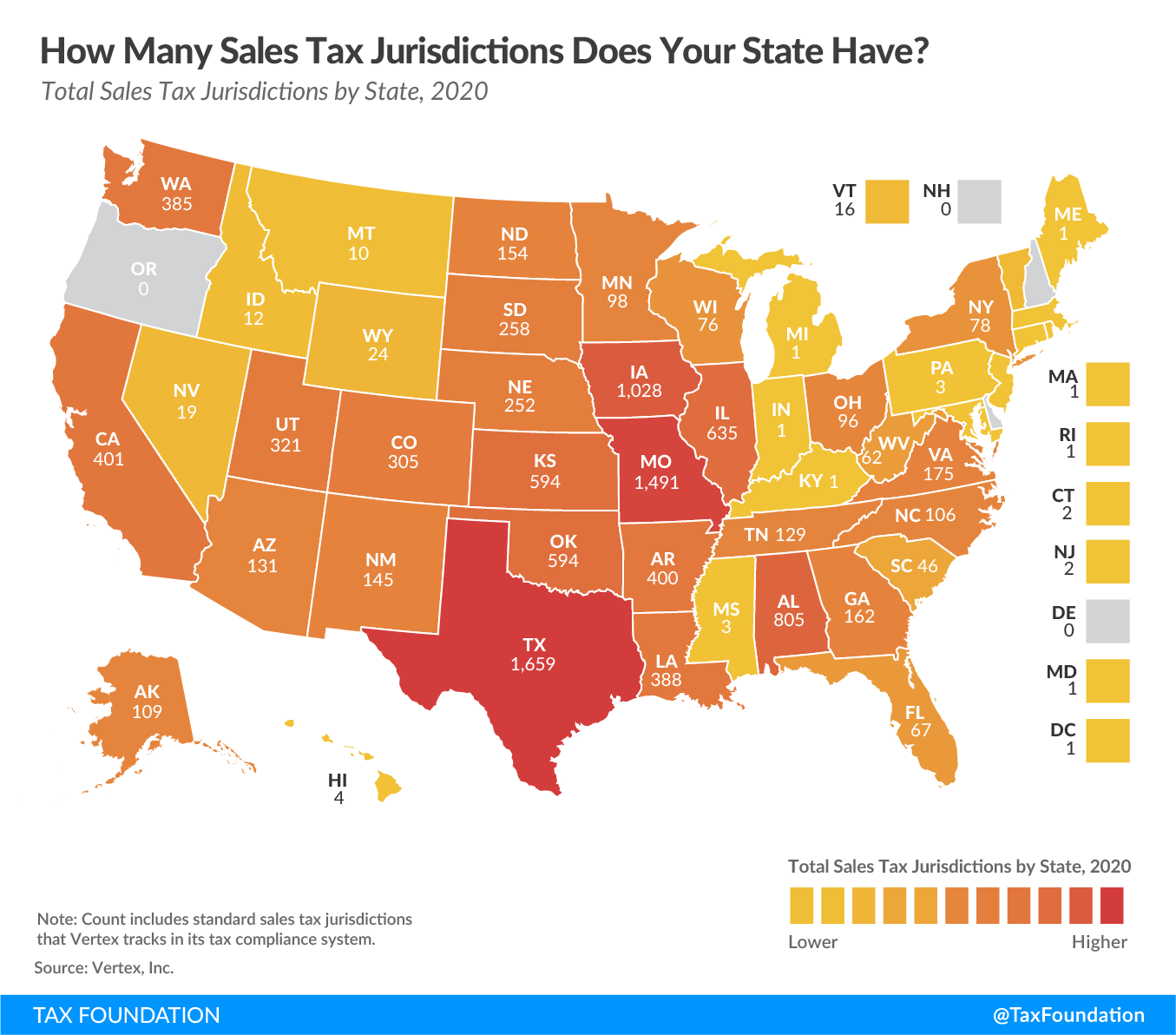

Marketplace facilitators must collect North. Remember that zip code boundaries dont always match up with political boundaries like Mayville or Traill County so you shouldnt always rely on something as imprecise as zip codes to determine the. So no matter if you live and run your business in North Dakota or live outside North Dakota but have nexus there you would charge sales tax at the rate of your buyers ship-to location.

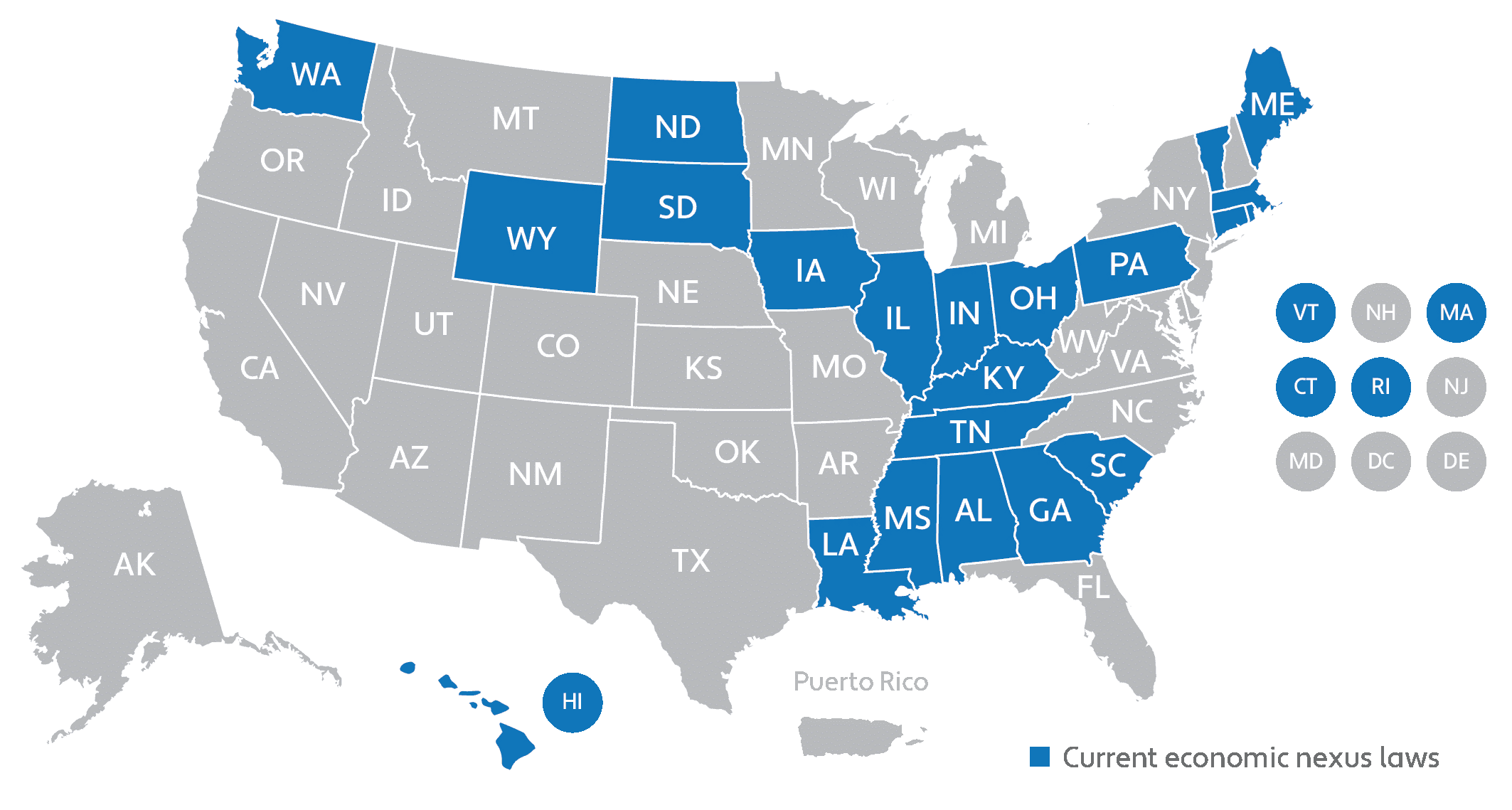

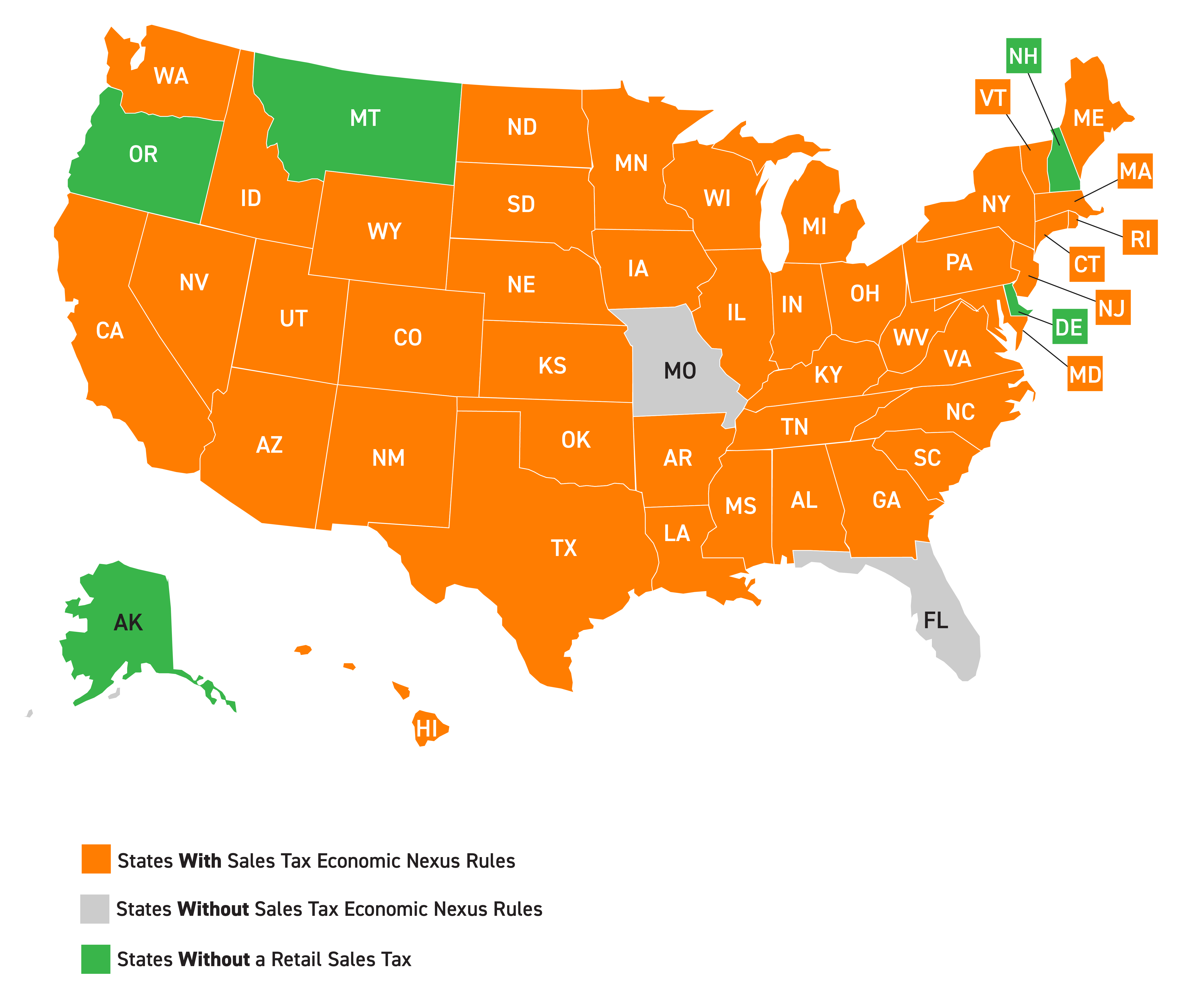

Nexus can be triggered by either physical or economic presence. North Dakota Enacts Economic Nexus Legislation Pending Quill Decision. A marketplace facilitator exceeding the sales threshold must obtain a sales tax permit and begin collecting tax on sales during the following calendar year or beginning 60 days after the threshold is met whichever is earlier.

Any kind of economic activity could trigger the nexus once your total sales reach a certain threshold amount. Economic nexus in North Dakota. If you had 100000 or more in taxable sales in North Dakota in the previous or current calendar year then you are required to register for collect and pay sales tax to the state.

North Dakota was the law of the land for sales tax nexus. There are approximately 1638 people living in the Mayville area. This is called an economic nexus a sales tax nexus determined by economic activity ie.

Assists clients with various compliance matters. A significant amount of sales in North Dakota within twelve months. If your business has a sales tax nexus in North Dakota you must charge sales tax.

North Dakotas economic nexus threshold is gross sales into North Dakota exceeding 100000 in the previous or current calendar year. Previous or current calendar year. Supreme Courts decision in South Dakota v.

North Dakota was the law of the land for sales tax nexus. Effective January 1 2014 sales tax permit holders that reported 333000 of taxable sales and purchases in the previous calendar year must file returns electronically. North Dakota removed its 200 transactions threshold effective for tax years beginning after December 31 2018.

Tax Commissioner Brian Kroshus announced today that North Dakotas taxable sales and purchases for the first quarter of 2022 are up 132 compared to the same timeframe in 2021. You will have to comply with the state of North Dakotas individual sales tax laws and apply for. North Dakota took place in North Dakota in 1992.

It could be having a physical site eg a brick and mortar business or having someone working for you in the state. Having a certain amount of economic activity in South Dakota could trigger nexus under Senate Bill 106 which creates a tax obligation for out-of-state sellers meeting one of the following criteria in the previous calendar year. State Sales Tax The North Dakota sales tax rate is 5 for most retail sales.

Gross sales in excess of 100000 NOTE. The Mayville North Dakota sales tax rate of 7 applies in the zip code 58257. You can find guidance on economic nexus from the North Dakota State Tax Commissioner here.

New mobile homes at 3. Taxable sales and purchases for January February and March of 2022 were 47 billion. Marketplace sales excluded from the threshold for individual sellers.

New farm machinery used exclusively for agriculture production at 3. Wayfair in 2018 Quill Corporation v. You need to get a sales tax permit and comply with sales tax laws if you have nexus or a connection to the state of North Dakota.

You can read about North Dakotas economic nexus law here. North Dakota is a destination-based sales tax state. The legislature authorized sales tax refunds of up to 2500 per household on residential property that was replaced due to 2011 river flooding.

Research and review state sales tax and transactional tax issues including nexus determinations and taxability reviews. Gross receipts tax is applied to sales of. Generally a business has nexus in North Dakota when it has a physical presence there such as a retail store warehouse inventory or the regular presence of traveling salespeople or representatives.

We get a lot of questions about this and recognize it may be the most difficult hurdle for businesses to overcome. 100000 North Dakota removed its 200 transactions threshold effective for tax years beginning after December 31 2018. North Dakota sales tax is comprised of 2 parts.

A remote seller must register and begin collecting sales tax in North Dakota on October 1 2018 or 60 days after the threshold is met whichever is later. Busineses with nexus in North Dakota are required to register with the North Dakota Department of Revenue and to charge collect and remit the appropriate tax. If you meet this threshold it does not matter if you have a physical presence in North Dakota.

The North Dakota sales tax rate is. In different states the term sales tax nexus signifies different things. After determining you have sales tax nexus in North Dakota you need to register with the proper state authority and collect file and remit sales tax to the state.

It can also refer to having a affiliate or click through sales tax nexus in the case of ecommerce. Common Ways to Have Sales Tax Nexus in North Dakota. One of the foundational court cases regarding sales tax nexus Quill Corporation v.

The remote sellers gross revenue from sales of taxable goods or services delivered into South Dakota exceeds. One of the foundational court cases regarding sales tax nexus Quill Corporation v. Thursday June 23 2022 - 0900 am.

- the amount of sales you make in a particular state. Supreme Courts decision in South Dakota v. North Dakota took place in North Dakota in 1992.

A typical day as a State and Local SalesUse Tax AssociateSenior Associate might include the following. According to state law remote sellers must collect North Dakota sales tax if their sales into the state exceed 100000 in the current or previous calendar year.

Redefining Online Sales Tax South Dakota Vs Wayfair And New Tax Compliance

Out Of State Sales Tax Compliance Is A New Fact Of Life For Small Businesses

How To Register For A Sales Tax Permit In North Dakota Taxvalet

North Dakota Sales Tax Guide And Calculator 2022 Taxjar

South Dakota V Wayfair How A Supreme Court Case Is Revealing A 26 Year Old Congressional Dormancy Regarding Interstate Online Sales Tax Roosevelt Institute Cornell University

North Dakota Sales Tax Guide And Calculator 2022 Taxjar

Economic Nexus By State For Sales Tax Ledgergurus

Community Controls Sales Tax Update

Redefining Online Sales Tax South Dakota Vs Wayfair And New Tax Compliance

North Dakota Sales Tax Rates By City County 2022

Sales Tax Nexus 5 Signs Your Company May Owe Taxes In Other States Stage 1 Financial

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

South Dakota Defeats North Dakota Ends Physical Presence Sales Tax Nexus Debate Carter Shelton Jones Plc

Avalara Avatax Automated Solution For Ecommerce Businesses

Departments North American Reports U S Supreme Court S South Dakota Vs Wayfair Decision A New Alliance Between Dallas Fort Worth And London More Logistics Space In Savannah Ford S Continuing Investment In Detroit And Avs